We translated this comprehensive and thought-provoking text for our internal debate, trying to make sense of the situation we are in, but hope it will also be of interest for others. The original can be found here.

In the debates of the radical left in the 1970s, the talk was all too often about the crisis of capitalism. As a result, the radical left itself fell into crisis, and capitalism, in its post-Fordist variant, still showed much innovation and imagination. Communist systems (in China, for example) have produced new forms of state capitalism, while countries that still have regulatory and welfare apparatuses have moved to neoliberal practices. Everything that the workers’ movement has created over two centuries has fallen into ruins. Thus capitalism has been able to manage its crises in peace. The social costs of these crises are borne by the taxpayers anyway. From 2008/9 onwards, capitalism could continue its wild race until the next crisis.

It should be noted that the current problems were not only caused by Corona. The impending crisis holds something new, something we have never seen before in the history of capitalism. Of course, there are always different factors that contribute crisis, but this time there is a specificity to be observed. This specificity can be described in the words “paralysis of the logistics chain”. Logistics is closely interwoven with two other phenomena: globalisation and lean production. Logistics + globalisation have given rise to the so-called global supply chains. Lean production + logistics have turned a particular mode of production, originally intended for specific sectors of capital goods, into a general organisational form of capitalist commodity exchange. (1)

Logistics has been called the Physical Internet. This definition fits perfectly. Why? Information technology (or, as it is now called, digitalisation) is indispensable for managing the production process, but today it proves incapable of restarting the process when a physical, a prolonged material breakdown occurs simultaneously in different places. The physical component is stronger than the virtual component. Logistics creates one (or more) supply chain(s). The supply chain is a cooperation process between different services, the very substance of which is the synchronisation of the different links in the chain. Over time, this synchronisation has become denser and more precise. The incredible advances in computer science, robotics and sensor technology have created the illusion that every physical material obstacle can be overcome and that a trouble-free supply chain will solve all problems of geographical distance, provided that all actors in the chain spoke a common language in the virtual world and agreed to share their data with their partners.

Here, the problem initially arose that the participants would have to provide each other with internal data in order to achieve perfect synchronisation. This seemed too big a sacrifice for many companies. Then there was the question of who should rule the roost, since synchronisation depends on planning and synchronisation without planning is not practical. In order to avoid conflicts between market leaders, these problems were imposed on enterprises that do not have sufficient power to act independently because they cannot afford any other form of existence than that of sub- or sub-sub-enterprises. There is perhaps no other area of production and trade where so many companies provide their services “on behalf” of someone else. All members of a supply chain manipulate or transport something that is not their property. Many are companies that provide the physical, material performance of the supply chain, but are contractually absent from the chain. This leads to new communication problems because not all subcontractors are able to equip themselves with the same level of technology as the market leaders. Digitisation costs money. Conclusion: Even before today’s crisis, the framework of global supply chains was much more unstable and unreliable than it appeared.

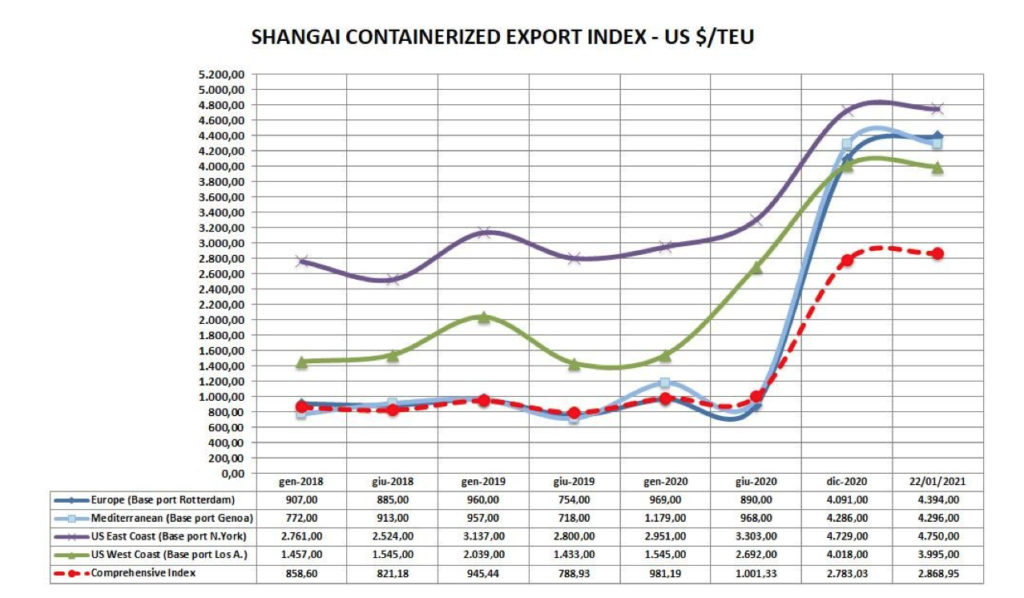

Corona suddenly changed everything in terms of the physical distance between people, between things and between people and things. With the onset of the pandemic, physical synchronisation was at an end, while the virtual world seemed to continue almost undisturbed. In the past, if there was a breakdown in the logistics chain, for example if a certain container ship was two to three days late in calling at a port, today’s IT solutions made it possible to reprogramme a loading and unloading cycle that had already been pre-programmed weeks ago in a short time: from the shipper’s warehouse to the delivery of the container to the terminal gate, from the customs operations to the processing of the travel documents and possibly even to the rerouting of the goods, combined with a change of ship. The flexibility of the supply chain had reached a very high level and the technicians and experts were able to deal with emergencies. Of course, this requires a high, although not total, flexibility of work performance. Corona has crippled the two pillars of logistics, globalisation and lean production, which seemed to be advancing inexorably. Through the use of two flexible resources, manpower and IT solutions, it used to be possible to manage emergencies. The real nightmare for logistics operators was not the physical breakdown within supply-chains, but potential cyberattacks – (translators note: it seems that the significance of IT was over-emphasised). Maritime transport used to cost almost nothing and companies tended to be wasteful with transport capacity. Today, a shipment costs x times as much.

Currently, with the radical change regarding physical distance, everything has become confused. In the production facilities, white-collar workers were allowed to work from home, but blue-collar workers were not. The protective measures against Covid-19 caused the planning of the production process, which had previously been fine-tuned down to the millimetre, to fall apart. The real breakdown came when the global supply chain was infected by millions of breakdowns. This was spectacular in maritime transport and especially in container transport. The introduction of giant ships with capacities over 20,000 TEU (2) in 2017/2018 and the resulting concentration of traffic on two routes (Asia – Pacific – West Coast of the USA and Far East – Northern Europe) with few ports of call drastically reduced the alternatives. As soon as these ports were no longer able to load and unload containers due to staff shortages or temporary work stoppages, the paralysis spread to the last shipper thousands of kilometres away from the port. (3) Crisis situations that were latent have now erupted, for example the long-lasting worldwide driver shortage. This is particularly affecting the United States and Western Europe. The driver shortage is one of the main reasons for the crisis in the American Pacific ports. They are unable to unload container ships from China in time. Port congestion is the nightmare of logistics today, and this situation will continue for some time.

But the highest price is paid by the ship crews. In order to protect themselves from Corona, many countries and port administrations have forbidden the crews of foreign ships to disembark. This blocked crew rotation (the change of crew after six months of service). In the worst cases, crews had to spend months on board without supplies. The case of a ship owned by the shipping company Italia Marittima, based in Trieste but owned by the Taiwanese company Evergreen, was cruel. The commander died on the way from India to Singapore. For a month, the shipping company tried to find a port in Southeast Asia that would have been willing to allow the commander’s corpse to be offloaded. Even Italian diplomacy supported this attempt. In vain. The ship had to return to Italy with its entire cargo and with its dead commander in the freezer where the provisions are stored, and then back to Singapore to deliver the cargo. (4) Currently, at least in Europe, with the introduction of the Corona vaccination card, the situation of crew changes is returning to normal. In Asia, on the other hand, there are still major problems in countries with access to the sea, such as Malaysia, Indonesia, the Philippines and South Korea, while in China the rules are constantly being changed and in Singapore bureaucracy complicates everything. (5) Between 35 and 40 per cent of all global container traffic is concentrated in this area.

The living and working conditions of seafarers are generally miserable, and the relatively better wage conditions are only an insufficient compensation for this. The suicide rate among seafarers has recently skyrocketed. (6) As long as the paralysis of supply chains continues, these conditions will continue to deteriorate. In the context of the pandemic and even before, the press has reported extensively on the situation and conflicts of bicycle couriers, but has hardly said a word about the terrible sacrifices of seafarers. Where physical distance becomes a problem, transport takes on extraordinary importance. Today’s crisis in container transport has called into question the progress of globalisation, which was already not so popular, even among certain conservative circles. Promptly, however, big business has reacted and warned that reshoring is unthinkable. This is the case, for example, for the IFO Institute in Germany, and the responses in surveys of companies conducted by the Central Bank in Italy go in the same direction. (7) There is no going back from globalisation, There Is No Alternative? At the same time, the newspapers report daily on bottlenecks and production interruptions in industries, and a shortage of strategically important components such as semiconductors. (8) Even worse are the price increases for important goods and fuels.

The spectre of inflation is returning after many years, and the central banks, both the Federal Reserve Board (FED) in the USA and the European Central Bank (ECB), do not want to give up their policy of quantitative easing. Sure, they have guaranteed huge profits for the financial world and enabled the multinationals to continue to operate not with equity but by increasing debt at the expense of savers. It seems that the paralysis of container traffic on the Pacific route is due to the consumerist madness of Americans in lockdown. The trade balance between China and the United States is 5:1, China exports all kinds of things and imports scrap, recycled materials. The so-called climate change will cost American citizens so much that they will soon have no money left to overconsume. But it will cost the European citizen even more. How anyone can talk about economic recovery in this situation is a mystery.

News from China says that because of the lack of energy supply, many production plants are forced to work only one day a week; for the other six days they remain closed. And this is happening in the provinces of Jiangsu, Zhejiang, Shandong, Guangdong, Guangxi, Yunnan, but especially in the Pearl River Delta. The working method of “open four and stop three” (open four days and shut three days) is considered optimal. However, the price of coal is too high, and the controls on energy consumption, which lead to a quota, are too strict. Seventy per cent of the power plants use coal to produce electricity. With the price increase of this raw material, they are no longer profitable. (9)

What’s more, there is the bankruptcy of groups such as the real estate giant Evergrande. Part of the Chinese banking world feels endangered by this, so much so that the Chinese central bank has been forced to inject the financial market with another new capital injection of 90 billion yuan (14 billion US dollars). (10) Will the restriction of production in China reduce the congestion at the ports? Maybe, but the factories in Europe that are waiting for components from China will have additional problems. The close interconnection of the links in the global production process built up by logistics has now become a boomerang.

What role does monetary and financial policy play in this context? Is it true, as some experts claim, that through the extraordinary Corona aid programmes the state has regained its importance in the economy? (11) Can it still exercise regulatory power in the market? Is it in a position to impose on the wild, “creative” international financial world a certain discipline? Yes, national economies today are dependent on government but this does not mean that the state (or public institutions) can or will bring order to the chaos of international finance. The central banks’ policy of zero interest rates or even negative interest rates has led to a general structural indebtedness. Our society is a debt society. Nations and companies continue to operate under a mountain of debt. (12) This leads to a very differentiated system of power relations. The “creative” international financial world is thus not diverted from its path. No state power is in a position to set limits to it. It produces, just as Marx had predicted, wealth ex nihilo. It seems to live on another planet, moving parallel to the material world of production and logistics. There seems to be no direct relationship, no direct contact between the two.

In these years the international financial world has shown an inventiveness rarely seen before in history, just think of the new figures of financial intermediaries such as SPAC (Special Purpose Acquisition Company) or the speculative “products” offered on the market – those that have led, among other things, to a series of criminal banking practices (Cum-Ex transactions, the Wirecard scandal, etc.). This international financial world has profited handsomely from the policy of “quantitative easing”. However, without this policy, without this debt, the states would not have been able to finance their spending, because they have all been in a chronic fiscal crisis since the 1970s (13). The United States is the best example of this. So there is no alternative, the policy of zero interest rates must continue.

One wonders today whether this policy will slow down or accelerate the progress of the threat of inflation. Can the monetary policy of the FED or the ECB prevent the price of Russian gas from rising? Certainly not. Huge amounts of capital are shifting towards environmentally friendly investments. What structural change will this shift bring to the international financial world? I don’t think anything similar will be done in the direction of socially sustainable investments. These, as always, have to be fought for. In this respect, it is remarkable that in Italy, but not only there, social conflicts have been emerging for ten years precisely in the logistics sector and spreading to other sectors. The protagonists of these struggles are no longer the mass workers of the 1970s, but proletarians who come from the hard experience of migration (14).

NOTES

(1) The literature on the development of logistics in the last ten years is very extensive, only a few references can be given here: Rob Hall, The Changing Face of Distribution. The Shape of Things to Come, Cushman & Wakefield 2019, [https://www.cushmanwakefield.com/en/united-kingdom/insights/the-changing-face-of-distribution]; the five editions of the DHL study, The Logistics Trend Radar (the latest is due out in November 2020), [https://www.dhl.com/global-en/home/insights-and-innovation/insights/logistics-trend-radar.html]; Bundesvereinigung Logistik (BVL) e. V., International Scientific Symposium on Logistics, 15. June 2021, Conference Volume, Bremen 2021, [https://www.bvl.de/files/1951/2142/2631/Conference_Volume_ISSL2021.pdf]. On the covid impact on the supply chain: Coronavirus and its Impact on Global Supply Chain, Impact of Coronavirus (SARS-CoV-2), Kearney, 24. February 2020, [https://globalmaritimehub.com/wp-content/uploads/2020/03/200224-Kearney-Coronavirusimpact-on-global-supply-chain.pdf]; German Chamber of Commerce Abroad, AHK World Business Outlook. Special Covid-19 Impact Survey. Results of a survey of German Chambers of Commerce Abroad, Delegations and Representative Offices, DIHK, July 2020, [https://www.dihk.de/resource/blob/25672/1a0e7354855aa46f3fccceb34f9eff30/ahk-world-business-outlook2020-corona-sonderbefragung-data.pdf], Hongyong Zhang, The Impact of Covid-19 on Global Production, Vox EU, 13. September 2021, [https://voxeu.org/article/impact-covid-19-global-production].

(2) TEU = Twenty Foot Equivalent Unit

(3) “A giant ship wedged across the Suez canal, record-breaking shipping rates, armadas of vessels waiting outside ports, covid-induced shutdowns: container shipping has rarely been as dramatic as it has in 2021.”: A perfect storm for container shipping, in: The Economist, 12. September 2021, [https://www.economist.com/finance-and-economics/a-perfect-storm-for-containershipping/21804500]; Will Waters, Latest ocean disruptions ‘highlight fragility of JIT model,’ Lloyd’s Loading List, 21. Juni 2021, [https://www.lloydsloadinglist.com/freight-directory/adviceandinsight/Latest-ocean-disruptions-%E2%80%98highlight-fragility-of-JIT-model%E2%80%99/79325.htm#.YWgPURxCQ2w]; Theo Notteboom / Thanos Pallis / Jean Paul Rodrigue, Disruptions and Resilience in Global Container Shipping and Ports: The Covid-19 Pandemic versus the 2008–2009 Financial Crisis, in: Maritime Economic & Logistics, 23 (2021), S. 179–210, [https://link.springer.com/content/pdf/10.1057/s41278-020-00180-5.pdf]. On the driver shortage: Verband der Chemischen Industrie e. V., Verbändeinitiative warnt vor Versorgungskollaps. Fünf-Punkte-Plan gegen Lkw-Fahrermangel, VCI, 13. Februar 2019, [https://www.vci.de/themen/logistik-verpackung/logistik/fuenf-punkte-plan-gegen-lkw-fahrermangel-verbaende-initiative-warnt-vor-versorgungskollaps.jsp]; Wissenschaftlicher Beirat beim Bundesministerium für Verkehr und digitale Infrastruktur (BMVI), Fahrermangel im deutschen Straßengüterverkehr – Strukturelle Treiber und verkehrspolitischer Handlungsbedarf [Driver shortage in German road freight transport – structural drivers and need for action in transport policy], February 2020, [https://www.bmvi.de/SharedDocs/DE/Anlage/G/fahrermangel-deutscher-strassengueterverkehr.pdf ?blob=publicationFile].

(4) The film ‘Deadweight’ (2016, Director: Axel Koenzen) takes a realistic look at the daily routine of today’s seafarers on a container ship.

(5) Author’s own information.

(6) John Konrad, Suicides aboard ships are rising at an unprecedented rate, gCaptain, 9. September 2021, [https://gcaptain.com/suicide-seafarers-distress-at-sea/].

(7) Giorgia Giovannetti / Michele Mancini / Enrico Marvasi, Globali del valore nella pandemia: effetti sulle imprese italiane [The role of global value chains in the pandemic: impact on Italian companies], in: Rivista di politica economica, 2 (2020), [https://www.confindustria.it/wcm/connect/7aa14bed-8eef-4937-95ed-b058093eff88/4-Giov a n n e t t i _ e t _ a l _ R P E _ n 2 _ 2 0 2 0 _ C o n f i n d u s t r i a . p d f ? MOD=AJPERES&CONVERT_TO=url&CACHEID=ROOTWORKSPACE-7aa14bed8eef-4937-95edb058093eff88nyjgcZy&__cf_chl_jschl_tk=pmd_XYoO5GCcNPZy2pVeg4g7OoRGdqoNmod0CaEcZTBqweA-1633685960-0-gqNtZGzNAvujcnBszQhl]. Nevertheless the textile company Benetton recently told the press that it wants to relocate production from Southeast Asia to the Mediterranean region: Trasporti via mare lenti e costosi: Benetton opta per il reshoring dall’Asia al Mediterraneo [Slow and expensive sea transport: Benetton opts for reshoring from Asia to the Mediterranean], Shipping Italy, 6 October 2021, [https://www.shippingitaly.it/2021/10/06/trasporti-via-mare-lenti-e-costosi-benetton-opta-per-il-reshoring-dallasia-almediterraneo/].

(8) Pauline Naethbohm, Chip shortage hits car industry: German manufacturers must deliver unfinished vehicles, Chip, 6 August 2021, [https://www.chip.de/news/Deutsche-Hersteller-verkaufen-unfertige-Autos-wegen-Chipkrise_183753660.html].

(9) Author’s own information. See also: China’s power cuts may foreshadow shortages of global goods, CNBC. shortages of global goods, CNBC, 28 September 2021, [https://www.cnbc.com/2021/09/28/ chinas-power-cuts-may-foreshadow-shortages-of-global-goods.html].

(10) Handelsblatt, Finance Briefing, 23 September 2021.

(11) For example, Erik F. Nielsen, Group Chief Economist of UniCredit Bank, London.

(12) A fundamental analysis of the “debt society” has been made by Paolo Perulli in his book ‘Il debito sovrano. La fase estrema del capitalismo’ [The sovereign debt. The extreme phase of capitalism], Milan 2020.

(13) “The ECB would not be in a position to raise interest rates sufficiently significantly even if inflation continues to rise, because then the debt burden of euro states like Italy would become unfinanceable.” Handelsblatt, Finance Briefing, 1 October 2021

(14) For detailed reports on the strike movement at major logistics hubs see can be found in number 3 of the magazine Officina Primo Maggio, June 2021, [https://www.officinaprimomaggio.eu/la-variante-logistica-cronache-e-appunti-sui-conflitti-in-corso/].